Brian Foltyn, CVA, REDW Advisors & CPAs

The countdown has begun for a significant shift in the lifetime gift and estate tax exemption landscape. The temporarily increased exemption amounts provided under the Tax Cuts and Jobs Act of 2017 (TCJA) are set to expire at the end of 2025, which presents an unprecedented, but fleeting, opportunity to advise clients of strategic wealth transfers before the window closes and tax exposure increases.

Optimal Assets for Gifting

Minority interests in privately held companies remain the asset of choice for strategic gifting. Such gifts can benefit from discounts for lack of control and lack of marketability, typically reducing the reportable gift value well below the appraised pro-rata enterprise value. Family-held real estate and investment entities can also receive discounts, provided the entities are properly managed and documented.

Don’t Wait for Certainty – Lessons from 2012 / 2013

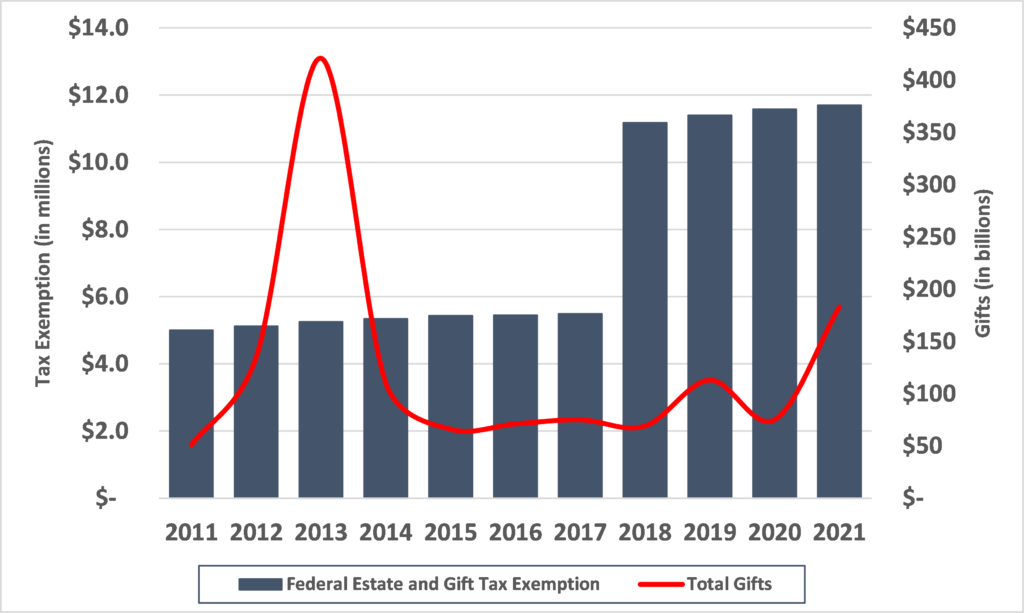

Back in 2012, advisors were bracing clients for the possibility that the federal estate tax exemption would plunge to $1 million, and the maximum estate tax rate would increase to 55%. This perceived threat prompted a rush among higher-net-worth individuals to make significant gifts, resulting in a notable uptick in gifting activity and a surge in demand for qualified appraisers who could deliver under tight deadlines.

The run-up to 2013 demonstrated the pitfalls of waiting for legislative clarity. Many tax professionals, attorneys, and appraisers recall that late 2012 brought a backlog of last-minute planning and gifting, driving a spike in appraisal requests that strained industry capacity. Back then, taxpayers sought to lock in higher exemptions and lower tax rates, anticipating drastic changes. Although Congress did not reduce the exemption to $1 million as feared, those who acted early were able to implement sophisticated gifting structures without scrambling at year-end or risking incomplete transactions.

Valuation – A Bottleneck in Busy Years (may get worse)

Similar dynamics are unfolding today. Despite political uncertainty over what the final exemption will be post-2025, the prudent course is early action. Memories of 2012-2013 highlight how waiting until the last quarter of the year can leave clients unable to find available qualified appraisers to execute their plans – and 2025 could be worse. Proposed changes to IRS Circular 230, if passed, would mandate that all appraisals submitted to the IRS comply with USPAP or IVS valuation standards instead of those standards consistent with an appraiser’s professional credentials. Strictly requiring adherence to USPAP or IVS could lead to confusion, increased compliance burdens, and potentially reduce the pool of appraisers willing to work on IRS-related matters[1].

Actionable Steps, Post-Sunset Planning, and Professional Collaboration

Given the high likelihood of a late-2025 rush—and the lessons from 2012—it is crucial for advisors and their clients to act deliberately and early. Initiate estate plan reviews, engage with valuation professionals, and coordinate legal documentation for gifts well before the end-of-year bottleneck. Treasury has issued guidance confirming that gifts made under current, higher exemptions will be honored, even if exemption amounts decrease later. There will be no retroactive taxation (“clawback”) on completed gifts, so leveraging the current exemption is a powerful risk management strategy. Early movers will have greater flexibility and be better positioned to implement advanced strategies, maximizing wealth transfers and minimizing future tax exposure.

Final Thoughts

We are on the cusp of the largest drop in the federal exemption in over a decade. As history shows, uncertainty breeds last-minute activity and inevitable bottlenecks. Clients, guided by their advisors, should now consider taking full advantage of the elevated exemption before it disappears. Waiting could mean higher taxes and missed opportunities for generational wealth preservation.

Brian Foltyn leads REDW’s Valuation & Related Financial Services practice, backed by 28 years of professional experience in both industry and public accounting, which includes business valuation advisory services, strategic planning, dispute advisory, forensic accounting, and mergers & acquisitions.

[1] As Treasury and the IRS review extensive public commentary, the final form of the regulations remains pending, and the profession awaits further guidance.